Acctual Team

•

Oct 21, 2024

The first two things you’ll need to get started with cryptocurrency are a crypto exchange account and a crypto wallet.

Exchanges enable you to buy crypto using standard fiat money, like Dollars.

Wallets let you store, send, and receive crypto funds like Bitcoin.

The problem is:

Innovation is blurring the lines between the two, making it tricky to understand the difference between a crypto wallet and an exchange.

Nowadays you can store crypto on an exchange and trade crypto from a wallet.

So, how is a cryptocurrency exchange different from a cryptocurrency wallet?

Below, we’ll discuss the nuts and bolts of the crypto wallet vs exchange debate in simple English, including definitions, pros, and cons of each. We'll also explain the easiest way to get paid using crypto without needing any technical knowledge.

What are crypto wallets?

A crypto wallet is an application or device for storing, sending, and receiving cryptocurrency and interacting with blockchains.

They are a crucial element in the cryptocurrency ecosystem as they offer users self-custody of their assets. This means you don’t have to trust a 3rd party institution, like a bank, with your funds. Self-custody allows you to retain control of your assets so no government or organization freezes or takes them from you.

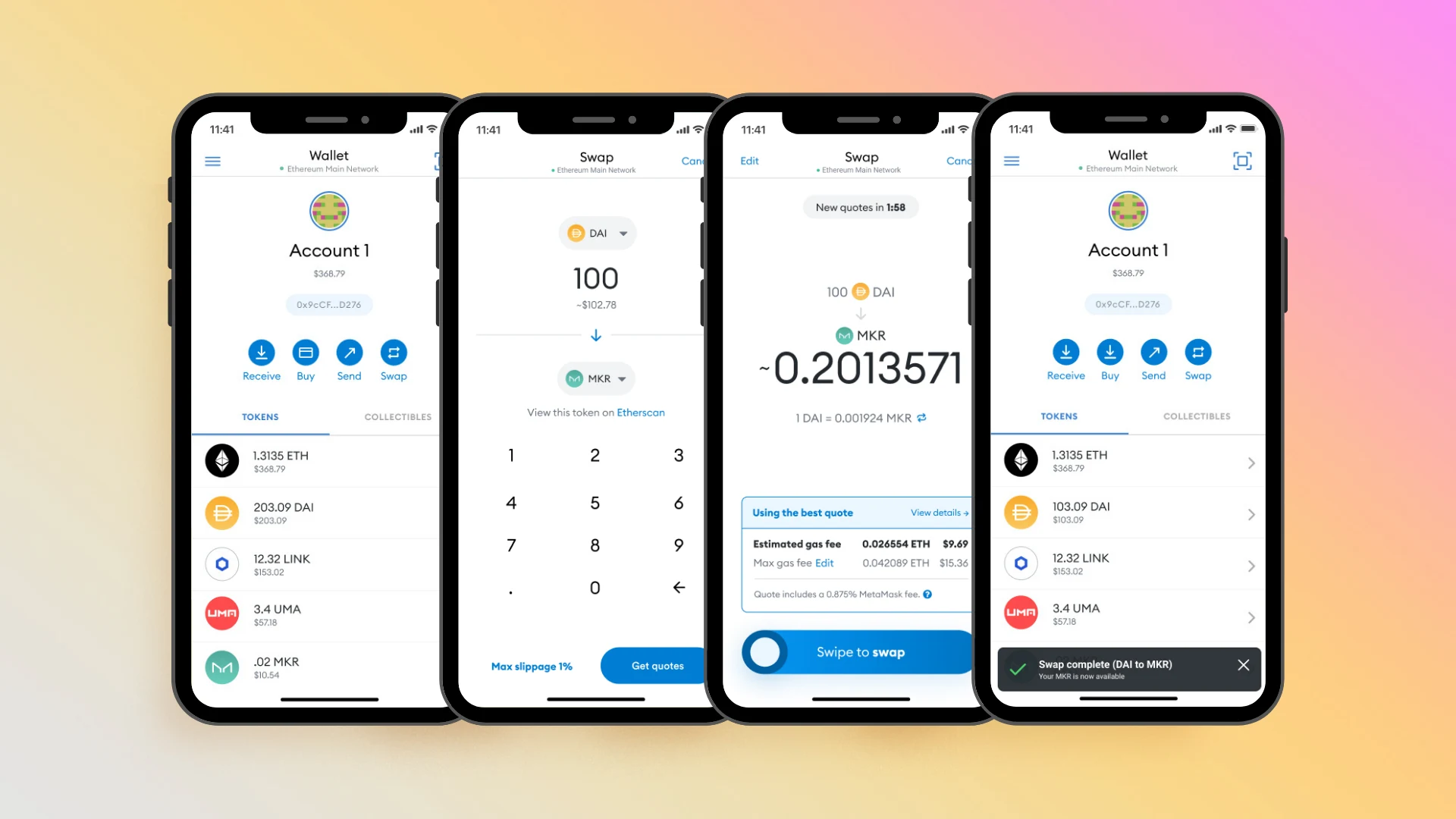

Above you can see example screenshots of MetaMask, one of the most popular crypto wallets in the world

The most basic function of a crypto wallet is the secure storage of your private key. This cryptographic key is used to control your cryptocurrency. Anyone with access to the private key can send funds from your wallet. Therefore, you should never reveal it to anyone.

Types of crypto wallets

Choosing a crypto wallet gets complicated, especially for newcomers. There are several different types making them difficult to categorize. However, if you’re learning about crypto wallets for the first time, they can be divided into the following areas:

Software wallets

These wallets run in a software application directly on your computer, web browser, or phone. They are the most common and allow you to start holding, receiving, and sending cryptocurrency in a matter of minutes. Most can be downloaded for free as they are open source, or companies make money via different methods in the application. As they run on your computer or phone, they are very convenient and useful for making regular payments or interacting with decentralized apps (dApps). Popular examples include MetaMask and Coinbase Wallet.

Hardware wallets

These are similar to external hard drives or USB sticks. The wallet application and private key are installed on the external device. This allows you to store your crypto offline when not in use, making it harder for hackers to access your keys. They have a physical button to confirm payments for added security. It’s the consensus that hardware wallets provide the best balance of security and convenience. Hardware wallets offer similar functionality as software wallets, including Web 3 actions, plus they can still receive funds even when disconnected. You’ll need to buy a secure hardware wallet to get going, but reputable companies like Trezor and Ledger offer them for less than $100.

Cold storage wallets

If you want to hold large sums of crypto for long periods, then it’s worth considering a cold wallet. These are self-custodial wallets that are never connected to the internet until the time comes to use funds. You can even set them without connecting to the internet for ultimate security. They take various forms, from hardware devices to physical records. Physical cold storage wallets involve stamping a private key into metal so it is fireproof. Incredibly, you can create a paper wallet to store your crypto in the most basic form.

The risks of crypto wallets

You should always be aware of the risks associated with self-custody wallets. Having complete autonomy is championed by crypto-lovers but when things go wrong it can cause permanent loss.

Software wallets are vulnerable to multiple attacks. Firstly, software developers have been known to build wallets with backdoor access for funds to be stolen at a later date. You even need to be careful when downloading software wallets from reputable sources like Apple app store. In 2024, a fake version of Rabby Wallet was listed on the app store costing unsuspecting users thousands.

Viruses can also give malicious actors access to your funds, while software bugs can expose private keys or lead to permanent loss.

Hardware wallets are more secure as they provide fewer opportunities for hackers to gain access to your wallet. However, they can still be troublesome if you’re not careful. User error is a common risk that costs users all or part of the funds, such as sending cryptocurrency to the wrong address. Mistakes like this are unrecoverable.

Hardware wallets still require a software application to operate when connected to your phone or computer. Although rare, problems like a fake Ledger Live app sneaking into the Microsoft Store can lead to theft—$600,000 worth in that case.

Phishing attacks are also common, no matter your wallet type. This scam tricks you into revealing sensitive information or interacting with a fake crypto application. Scammers often use lookalike emails and websites to convince users to send them funds.

All self-custody wallets run a risk of failing or being destroyed accidentally. Whether on a laptop, external device, or cold wallet, if you don’t back up your private key or recovery seed phrase you leave yourself exposed to permanent loss.

Best practices for managing crypto wallets

Seed Phrases: Store your seed phrase in a secure, secret location. You’ll use it to recover your crypto wallet if you lose it or it is destroyed. Write it down with pen and paper and store it in a fireproof, floodproof manner. Never back up a seed phrase on an internet-connected device.

Anti-malware: Ensure that any devices you use have robust anti-virus software. Conduct regular malware scans and update your devices (phone and computer) to keep them secure.

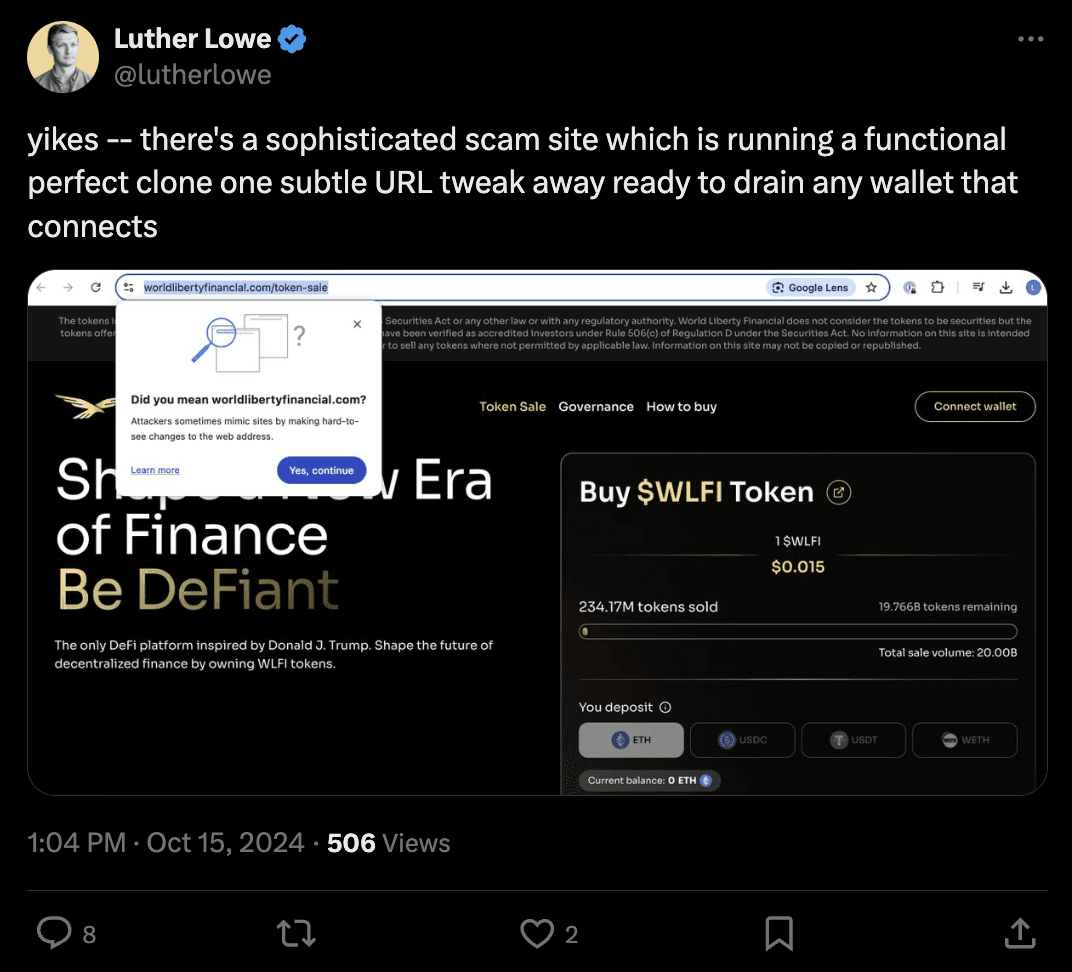

Check domain names: When interacting with crypto websites and Web 3 apps, double-check the domain name/URL you are accessing. Scammers commonly impersonate websites and marketing materials to trick users.

A fake domain in the wild

Be wary: If you receive unknown cryptocurrencies and NFTs in your wallet, be very wary of interacting with them. If you need clarification on what they are, dispose of/hide them in the interface. Some may have QR codes and links accompanying them, leading to malicious websites.

Monitor wallets: Regularly check your wallets and any dApp permissions that have been granted. If you don’t recognize any, you should immediately revoke access. Platforms like Revoke.cash can help you inspect and revoke wallet approvals.

Check payment details: When sending funds from your wallet, make sure you are sending to the right wallet address. Also, check that you’re on the right blockchain network. Some assets have multiple versions, each for different chains.

So that’s everything you need to understand about wallets. Next, let’s tackle the question: how is a cryptocurrency exchange different from a crypto wallet?

What are crypto exchanges?

Crypto exchanges allow you to buy and sell cryptocurrency. They are crucial for anyone wanting to use cryptocurrency. It’s the most common way to bridge the gap between the crypto world and the fiat world. You can create an exchange account, deposit money via bank transfer or credit card, and trade it for cryptocurrency like Bitcoin. Plus, they enable you to ‘cash out,’ so you can trade crypto for fiat money like US Dollars. Then, withdraw the money to your bank account.

The most famous crypto exchanges, such as Binance and Coinbase, are centralized exchanges. This means they are operated by a company - similar to a bank. Like a traditional bank account, these companies hold and manage funds on your behalf based on your requests.

You shouldn’t confuse these centralized exchanges with decentralized exchanges (DEX). DEXs are different because they don’t allow you to store crypto funds on the platform and can only be used to trade using a crypto wallet.

What is an exchange wallet?

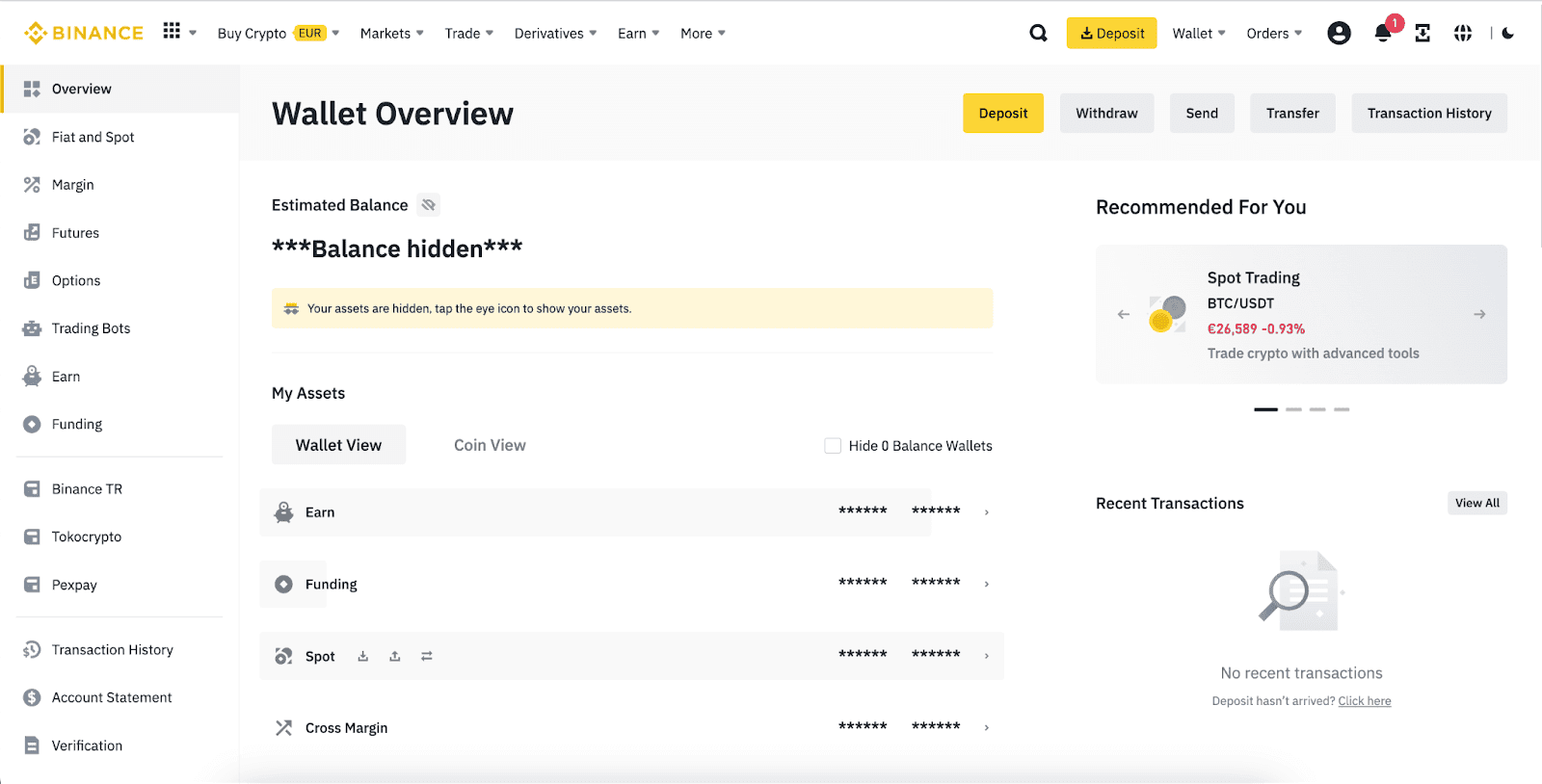

The Binance exchange wallet interface

You might hear people refer to ‘exchange wallets’, this is simply another way of referring to your account-used funds on an exchange platform. This also sparks discussions about centralized vs decentralized wallets. A centralized wallet is controlled by an institution like an exchange while a decentralized wallet is self-custody.

The risks of crypto exchanges

The top crypto exchanges have built up trust and respect in the industry. They are generally considered secure places to store your funds, but this is not always guaranteed. Self-custody is a heralded feature of cryptocurrency, and with exchanges, you are trusting a third party to hold your crypto.

You don’t have to worry about keeping your private key safe. The exchange runs your wallet and holds the private key. It sounds easier, but there’s a phrase in crypto: ‘Not your keys, not your coins.’ It refers to the fact that if you surrender control of your private key, you surrender ultimate control of your crypto. It’s not unheard of for exchanges to be hacked or operate fraudulently. This is famously the case with Mt. Gox and FTX, which lost $400 million and $8 billion of customer money, respectively.

As crypto exchanges aren’t as tightly regulated or subject to the same consumer protection as banks, lost funds may never be recovered or compensated for.

This makes it increasingly important to use the most trusted and well-regulated exchanges. New exchanges or those dodging government regulation present an unnecessary risk for customers. Be aware of exchanges running aggressive promotional campaigns. Operators might even be planning an exit strategy to disappear with funds. Before depositing any money, do thorough research on company history, founders, and customer reviews.

Best practices for managing crypto exchange accounts

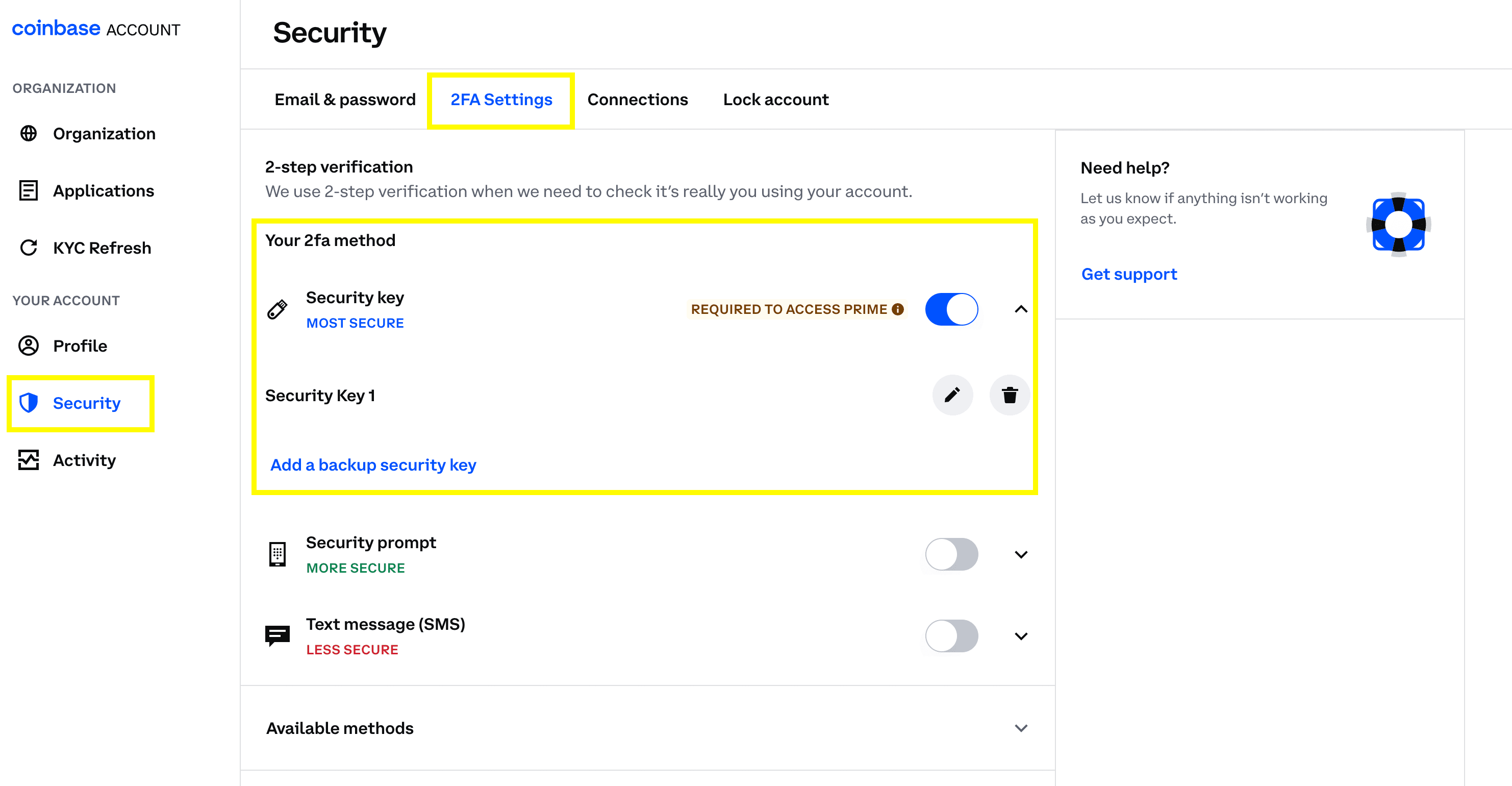

2FA: Always switch on 2-factor authentication (2FA) on your account. This stops access to your account with a single password and requires a second code via email, phone, or an authentication app.

Security: Keep your password secure, don’t store it online, and keep your 2FA safe. Anyone who has both pieces can access and drain your account.

Phishing scams: Beware of phishing attempts where scammers create a fake website or communication to trick you into giving them sensitive information or your cryptocurrency.

Check domains: To avoid phishing attacks, double-check and triple-check that you are using the right domain name every time. Bookmarking the exchange rather than accessing it via Google, social media, or email links is a good idea. Never trust unrecognized links.

Withdrawals and deposits: When withdrawing and depositing funds on a crypto exchange, make sure you are using the right wallet address and checking you are on the right blockchain network.

Monitor news: Keep track of crypto news and consider withdrawing your funds if there are any red flags regarding the exchange. There’s plenty of choice so don’t risk it.

An alternative to crypto wallets and exchanges: Acctual

Here’s a crypto exchange vs wallet dilemma for you:

Crypto exchanges require trust in their security measures, which have been known to fail.

Crypto wallets require you to run security measures that are easy to get wrong.

Neither seems appealing. Particularly if you deal with lots of crypto payments and don’t want to make an easy mistake. This is where Acctual shines.

Acctual can help solve these problems via our crypto to fiat wallet feature. You can invoice in crypto and funds are automatically converted before being sent to your bank account in your local fiat currency.

Need to pay bills in crypto for a vendor that only receives fiat? We can help there too. If you vendor uses an Acctual invoice you can send crypto or stablecoins like USDC/USDT to pay and it will automatically be converted. No need for you to send money from your wallet to an exchange, off-ramp, then pay via traditional methods.

We're the shortcut from crypto to cash.

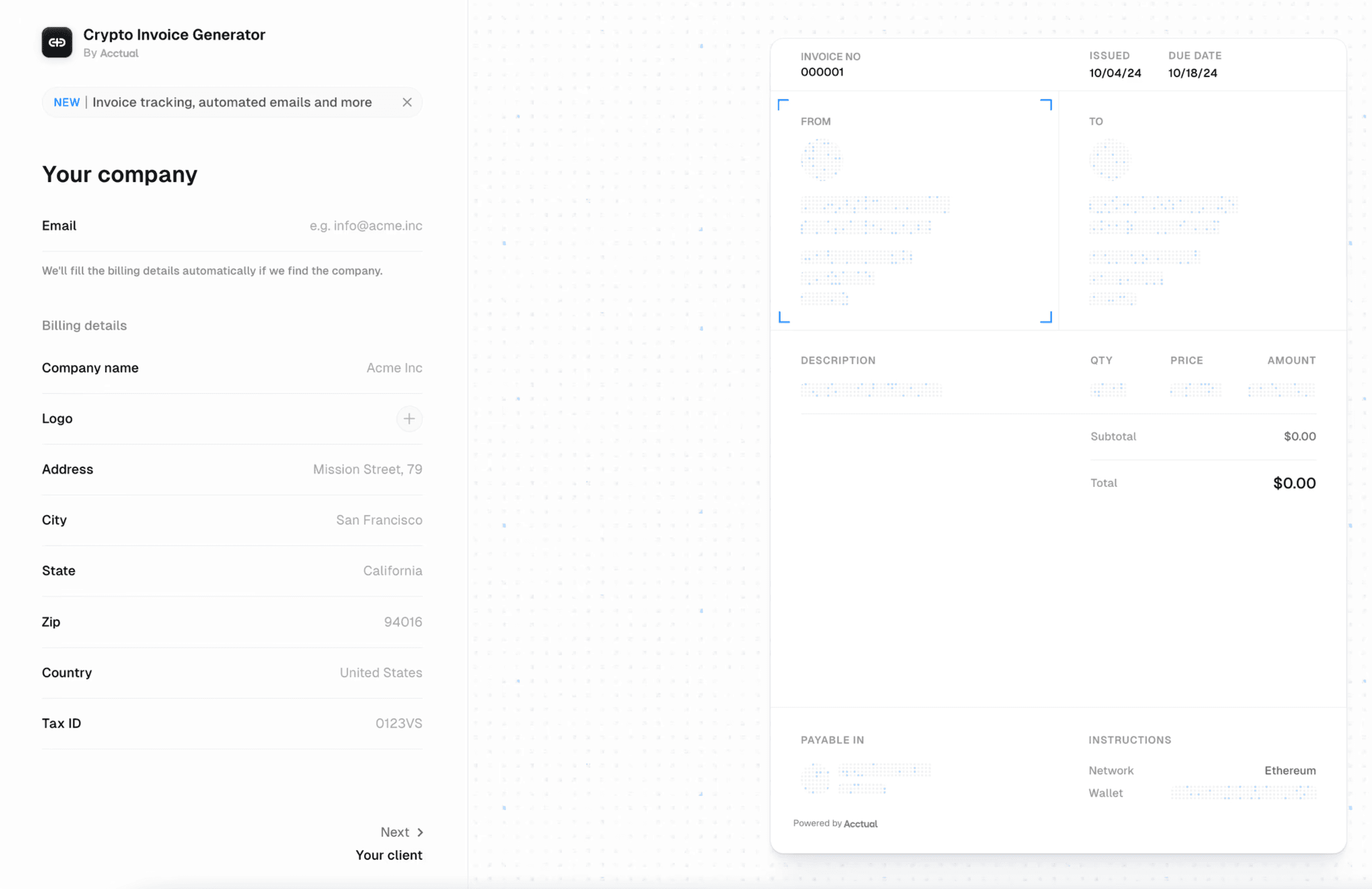

Plus, if you still want to get paid in crypto, Acctual will get rid of any costly mistakes. Simply generate an invoice that people can pay directly into your crypto wallet or exchange account. Try it for yourself with our free crypto invoice generator.

Our system is simple enough to work for part-time crypto freelancers and robust enough to handle the needs of complex crypto treasury management. Sign up for a free account today and discover the easiest way to pay and invoice in crypto.

Blog